DeFi Post-Crash: The Investor Trend Discrepancy (- Wild Reactions)

# Solana's 2025: A Data Analyst's Reality Check

Solana. The name alone conjures images of sleek interfaces, lightning-fast transactions, and, of course, stratospheric price predictions. But let’s strip away the marketing gloss and look at the hard numbers as 2025 draws to a close. What’s the real story behind Solana’s performance, and can its claims of dominance hold up under scrutiny?

Solana's Throughput: Reality vs. Theory

The first thing that jumps out is throughput. Solana boasts over 1,000 transactions per second (TPS), a figure that dwarfs Ethereum's measly 30 TPS. But TPS alone is a misleading metric. It's like judging a highway by the number of cars that could theoretically pass, not the number that actually do, minus accidents. Real-world validation matters more than theoretical limits.

Solana's Infrastructure: Cracks in the Foundation?

A closer look reveals some cracks in the foundation. Solana's uptime, while generally high at 99.9%, isn't perfect. Those minor interruptions, often during software updates or peak demand (read: NFT drops), hint at a system that's still sensitive to stress. And while 1,295 active validators sound impressive, the Nakamoto coefficient of 20 suggests moderate decentralization, at best. A handful of entities control a significant portion of the network—a point that should give any investor pause. It's less a decentralized utopia and more a republic run by a few powerful families.

Solana's Tokenomics: Inflation and Staking

Then there's the tokenomics. SOL functions primarily as a utility token, used for transaction fees and staking. The idea is that real network activity drives demand, not just speculative hype. However, the 8% annual inflation rate (gradually decreasing, they promise) throws a wrench in the works. High staking rates (around 70% of the supply locked up) do reduce circulating supply, but if network adoption stalls, that inflationary issuance could easily offset any gains. It's a carefully balanced system, but one that could easily tip in the wrong direction.

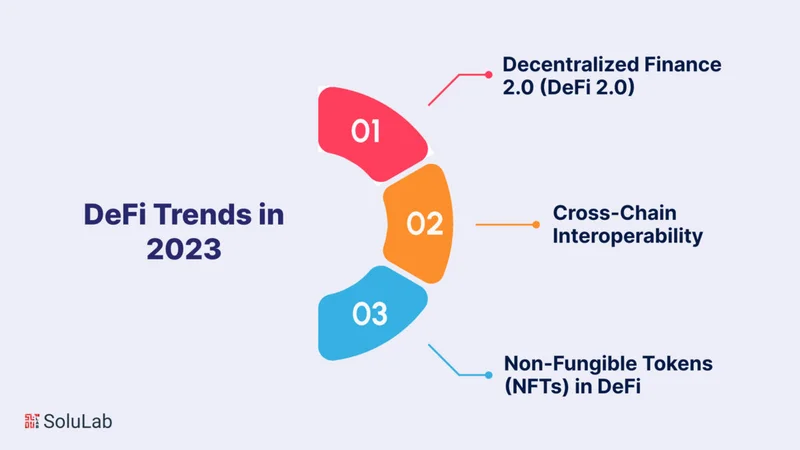

Solana's DeFi Ecosystem: Depth vs. Innovation

DeFi activity tells a similar story. Solana boasts a $5.1 billion TVL (Total Value Locked) in DeFi, indicating robust financial activity. But dig deeper, and you'll find that lending, borrowing, and liquidity farming dominate. It’s sophisticated, sure, but is it truly innovative, or just a faster, cheaper version of what’s already happening on Ethereum? And speaking of cheaper, Solana's average transaction fee of $0.00025 is undeniably attractive. But that's also part of the problem. It encourages microtransactions, which, in turn, can lead to network congestion during peak periods, like, you guessed it, NFT drops. It's a classic case of "you get what you pay for."

Solana's Price Performance: Volatility and External Pressures

Solana's price performance over the years reflects this uneasy balance. The 2021 surge, driven by the NFT boom and high-profile DeFi protocols, was impressive. But the subsequent market correction in 2022, which saw SOL plummet from $260 to $11, served as a stark reminder of the market's volatility and Solana's vulnerability to external pressures. (And I can't help but notice that these "external pressures" always seem to hit crypto harder than other asset classes.)

Solana's Price Projections: Base vs. Stress Scenarios

The projections for 2025 paint a cautiously optimistic picture. The "base" scenario forecasts a price range of $135-$160, predicated on sustained TPS, staking adoption, and moderate macro stability. But the "stress" scenario, which factors in a market-wide crypto downturn or temporary regulatory uncertainty, drops that range to $110-$135. The difference between these scenarios isn't about Solana's tech, but about the wider world. For further insights into market forecasts, see 15 Cryptocurrency Forecasts For 2025 (Updated).

Solana as an Investment: Risk vs. Reward

So, is Solana a good investment? It depends. The data suggests that Solana has carved out a niche for itself as a fast, efficient, and relatively inexpensive Layer-1 blockchain. But it also reveals vulnerabilities, from validator concentration to sensitivity to market fluctuations. It's a high-risk, high-reward proposition, and one that requires careful due diligence. The high throughput and low transaction costs are enticing, no doubt. But those advantages come with trade-offs in decentralization and potential network stress.

Solana's Correlation with Bitcoin: A Puzzling Paradox

And this is the part of the report that I find genuinely puzzling. If Solana's primary selling point is speed and low cost, why is it so heavily correlated with Bitcoin and Ethereum? The correlation with BTC, for example, averages around 0.72. That means that, regardless of Solana's technological advantages, its short-term price behavior is still heavily influenced by the broader market trends. It's like buying a Ferrari and then being stuck in traffic. The car might be capable of incredible speeds, but you're still at the mercy of the other drivers.

The Solana community, of course, will point to its vibrant ecosystem, its growing number of dApps, and its innovative approach to blockchain technology. And they're not wrong. But online discussions are often echo chambers, amplifying positive sentiment and downplaying risks. What I see in the data is a more nuanced picture: a promising technology with real-world applications, but also a system that's still evolving and one that's far from immune to the vagaries of the market.

Solana's Future: Discount the Hype

Ultimately, Solana's success hinges on its ability to maintain its technological advantages, expand its ecosystem, and navigate the ever-changing regulatory landscape. It's a race against time, and one where the outcome is far from certain. For investors, the key is to discount the hype, focus on the data, and understand the risks.

Solana's Reality: The Emperor Still Needs Clothes

Solana is a promising project, but it's not the messiah some proclaim it to be. It's a fast, efficient blockchain with real-world applications, but it's also a system with vulnerabilities and limitations. The numbers don't lie: Solana is a work in progress, not a finished pro

Related Articles

Grand Canyon Shutdown: What's Actually Closing and Why It's a Total Mess

So I was trying to read an article the other day, and this pop-up slams onto my screen. A "Cookie No...

Monad: Launch Details, Price Trajectory, and Reddit's Take

Monad's Grand Entrance: A Mirage of Activity and a Market That Doesn't Blink Monad, the latest conte...

Why Crypto Market Analysis Is Still BS

The Crypto Carnival Just Keeps Getting Weirder Okay, so Bitcoin's bouncing around like a hyperac...

Pudgy Penguins: The Price Hype and What We Actually Know

So, everyone’s losing their minds over whether the Pudgy Penguins crypto token, PENGU, can "defend"...

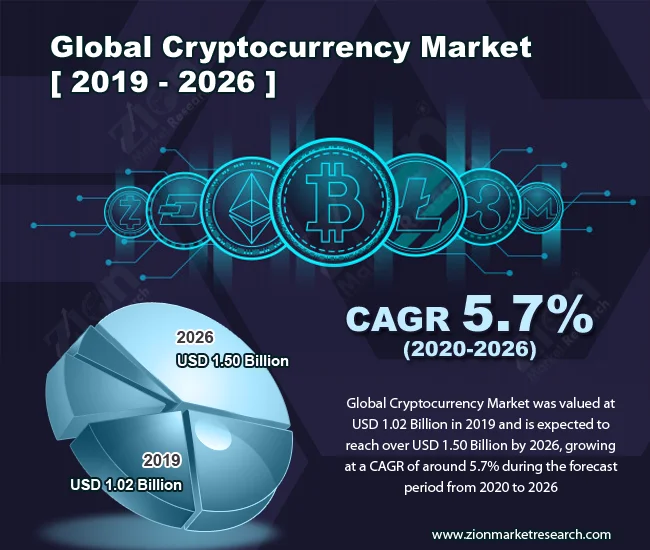

Cryptocurrency Market Analysis: The truth they're not telling you

Alright, let's get one thing straight: JPMorgan throwing out a $240K Bitcoin target is less about ac...

Blockchain Finance: The Data's Verdict - Crypto Twitter Reacts

Ethereum is turning ten, a milestone that invites reflection and, more importantly, a hard look at t...