Monad: Launch Details, Price Trajectory, and Reddit's Take

Monad's Grand Entrance: A Mirage of Activity and a Market That Doesn't Blink

Monad, the latest contender in the high-stakes Layer-1 arena, just threw open its doors. We’re talking about a network that boasts 10,000 transactions per second (TPS) and sub-second finality, designed to take the fight to Ethereum and Solana. Big claims, big promises, and a highly anticipated token launch. But less than 48 hours in, the grand unveiling took an immediate, if not entirely unexpected, turn. Users started reporting phantom token transfers, a digital sleight of hand that raises some pointed questions about the launch narrative versus the ground-level reality.

This isn't just a minor glitch. This is a crucial first impression for a blockchain positioning itself as a high-performance, EVM-compatible future. My analysis suggests what we're seeing is a classic tension: the technical definition of a "bug" colliding head-on with the practical experience of a user base navigating a new, complex ecosystem. And the market, as it often does, seems to be processing these signals through its own peculiar lens.

The Devil in the Explorer: What's "Not a Bug" When Everyone Sees It?

Here’s the rub: almost immediately after Monad’s mainnet and MON token went live, bad actors started spoofing token transfers. Monad CTO and co-founder James Hunsaker was quick to address it, stating on X that these were "fake ERC-20 transfers pretending to be from my wallet." He clarified that it’s "not a bug on Monad’s blockchain," but rather "spoofing within their smart contract to try to trick people."

Now, I’ve looked at hundreds of these technical disclosures, and this particular framing is, shall we say, interesting. From a pure code perspective, he's technically correct. If the blockchain itself isn't failing, and the malicious activity is happening at the smart contract level, it's not a protocol bug. But let's be precise here: the issue isn't that the blockchain itself is broken; it's that the interface users rely on—the block explorer—is displaying these fake events as legitimate activity. This is a critical distinction, and one that often gets lost in the technical weeds. It’s like saying your house isn't on fire, but the smoke detector in the neighbor's house is going off because someone keeps setting off fireworks in your yard, and firefighters are still showing up at your door. The practical effect for users is indistinguishable from a problem with the chain.

Shān Zhang, CISO at Slowmist, painted a clearer picture for Decrypt. He explained that scammers target new chains like Monad where transaction histories are "empty or chaotic." They generate "vanity addresses" that mimic users' real ones and then spam "zero-value transfers" to poison transaction history. The goal? To trick users into copying a fake address for future transactions. This isn’t a theoretical threat; it’s a direct, active attack vector. And the fact that explorers are showing these as "regular activity," complete with "fake swap calls and other artificial signatures," means the system designed to verify truth is, for all intents and purposes, lying to the user. My question is, at what point does a technically sound system that’s easily exploited and misleads its users become, in practical terms, fundamentally compromised?

The Curious Case of the Unfazed Market

Here’s where the numbers get really intriguing. While users were navigating this immediate confusion, the MON token itself was on a tear. After an initial airdrop that some speculators found underwhelming, MON's price surged. On Tuesday, it was up 19% from the previous day, trading at $0.042. To be more exact, that's a 68% increase from its initial price of $0.025 on Monday. This rapid appreciation pushed its market cap to around $500 million within days of launch. BingX, a significant exchange, jumped on board, listing MON and even offering a 50,000 USDT prize pool for depositors and traders.

This creates a fascinating dichotomy. On one hand, you have the immediate, tangible threat of spoofed transfers and address poisoning, a clear attack on user security and trust. On the other, you have a market that seems to be shrugging it off, driving the token price skyward. Is this the usual early-stage speculative frenzy overshadowing genuine concerns? Or is the market, in its infinite wisdom, correctly assessing that this "spoofing" is a minor, easily mitigated issue that won't impede Monad's long-term potential? It's a calculated gamble, to say the least.

The core of the issue isn't just that these attacks exist—they do on many chains—but that they surfaced immediately upon launch, and the system (explorers) unwittingly facilitates the deception. For a network touting high performance and scalability, the immediate challenge appears to be user security and clarity, not just raw transaction throughput. How much of this early price action is genuine belief in the tech, and how much is simply liquidity and FOMO in a shiny new toy, ignoring the foundational cracks that are already showing?

The First Impression: A Costly Education for New Users

Monad aims to be a home for "more complex and higher-throughput applications." But before we get to those grand visions, we have to ensure basic user safety. The fact that new users, fresh off an airdrop (roughly 76,000 wallets claimed MON), are immediately being targeted by address poisoning schemes is a brutal initiation. It’s like building a state-of-the-art skyscraper but forgetting to put locks on the front doors during the grand opening. Yes, you can tell residents to "check who started the transaction and confirm the token’s contract address," but that places a significant burden on the least experienced users, precisely the ones most susceptible to these tricks.

What does this say about Monad’s onboarding process, or more broadly, the crypto industry’s approach to user experience? We talk about mass adoption, but then we launch networks where the very tools meant to provide transparency (explorers) can be weaponized against users through technical loopholes. This isn't just about Monad; it's a systemic vulnerability that new chains, in their rush to market, often inherit or exacerbate. The question isn't if these attacks will happen, but how quickly and effectively a new chain can build a robust, user-friendly defense against them. And for Monad, that clock started ticking the moment their mainnet went live. Monad Hit With Spoofed Token Transfers Days After Mainnet Launch

The Market's Blind Spot

The market's reaction to Monad's early days is a case study in selective attention. On one side, you have a technically sophisticated blockchain launching with impressive performance specs, attracting significant capital and exchange listings. On the other, you have a glaring, immediate user security issue that, while technically "not a bug" on the core blockchain, fundamentally undermines trust and user experience. The price surge suggests investors are either unconcerned by this, or they believe Monad will rapidly implement solutions. My personal take is that the latter requires a level of proactive foresight that hasn't been fully demonstrated yet. The real test for Monad isn't just its TPS, but how it navigates this early reputational minefield.

The Real Cost of "Not a Bug"

Monad's initial days have laid bare a critical tension in the crypto space: the gap between technical purity and practical user security. While the MON token price soared, the underlying reality for many new users was a landscape already riddled with digital landmines. The technical distinction that this isn't a "bug" on the blockchain itself might satisfy engineers, but it does little to reassure a user staring at an explorer, confused by phantom transactions and wondering if their funds are truly safe. This isn't a problem that disappears just because you label it "spoofing." It's an immediate, front-line challenge to the credibility and safety of the entire Monad ecosystem. The market might be bullish, but the foundation of trust for its users is already under siege.

Related Articles

The October TV Dump: A Guide to What Isn't Total Garbage

So, how soon is too soon? Apparently, the answer is "never." It's been a year since the Hamas attack...

Grand Canyon Shutdown: What's Actually Closing and Why It's a Total Mess

So I was trying to read an article the other day, and this pop-up slams onto my screen. A "Cookie No...

Pudgy Penguins: The Price Hype and What We Actually Know

So, everyone’s losing their minds over whether the Pudgy Penguins crypto token, PENGU, can "defend"...

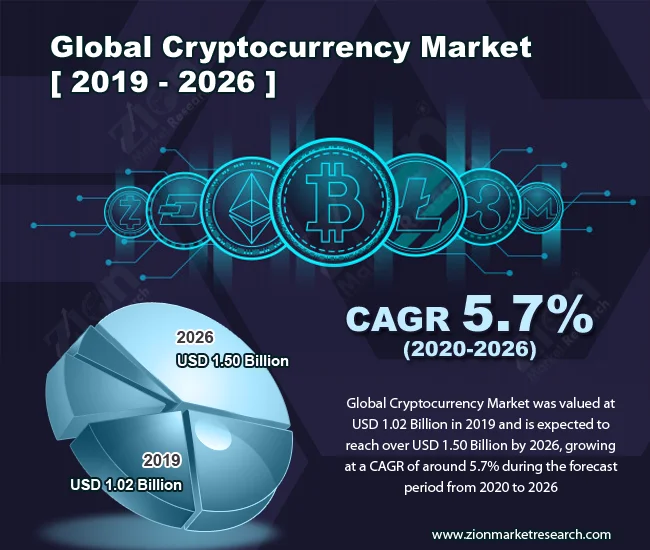

Blockchain Finance: The Data's Verdict - Crypto Twitter Reacts

Ethereum is turning ten, a milestone that invites reflection and, more importantly, a hard look at t...

Why Crypto Market Analysis Is Still BS

The Crypto Carnival Just Keeps Getting Weirder Okay, so Bitcoin's bouncing around like a hyperac...

Pi Network: What's Happening and If It's Finally Worth Anything

Okay, another day, another "revolutionary" partnership in the wild west of crypto. The suits over at...